Cosmetic Essence Innovations

Cosmetic Essence Innovations strives to operate as an extension of its clients’ manufacturing operations. By Alan Dorich

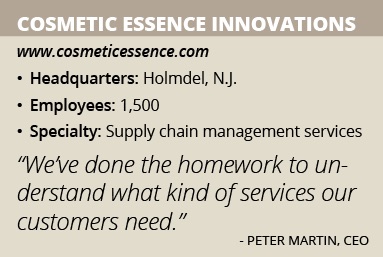

Cosmetic Essence Innovations (CEI) has stayed adaptable when it comes to serving its clients for the past three decades. CEO Peter Martin explains the company spends much of its time studying the in-house capabilities of its customers to meet their exact needs.

“We think that it gives us a leg up in being able to talk to our customers and prospective customers in a language that resonates,” he says. “We’ve done the homework to understand what kind of services our customers need.”

Based in Holmdel, N.J., CEI provides supply chain management services for the personal care and household products industries. These services include R&D, package design and sourcing, manufacturing and filling, and packaging and assembly. The company started operations in 1984 as a fine fragrance filler.

Over time, CEI grew through acquisitions. But in the last five years, it redefined the ways it engages with customers, Martin says. “The management group got together, really stepped back and said, ‘Does the marketplace want [what we’re offering], are we being recognized for having this, and do we do an effective job of marketing that capability on a broad basis?’” he explains.

Ultimately, CEI determined it needed to exit areas of its business and redefine itself. Today, “We focus on three core areas: performance skin care and hair care, fragrant body care, and fine fragrances and body mists,” Senior Vice President of Global Operations Andrew Davis says.

CEI’s customer base, Martin adds, ranges from entrepreneurial brands to multinationals. “We’re also dealing with relatively small start-up companies,” he adds.

“We’re a fairly sizable player,” Martin adds. “We believe we’re the largest third-party development manufacturing company focused on beauty care in the United States.”

Both Davis and Martin credit a good deal of CEI’s success to its R&D team, which can produce formulas for clients very quickly. With product cycles being relatively short, “Newness is an inherent part of the business,” Martin says.

“Being able to manage all that in a high-turnover industry is an incredibly difficult but critical aspect of running a company,” he admits. “It has to be managed [well].”

Taking Over

CEI offers turnkey supply chain services to its clients. “We have the capability of taking on or taking over the supply chain, from development to shipment for our customers,” Davis describes.

“We have the ability to source components and materials, convert those materials, package them and ship them to our customers’ distribution centers,” he continues, adding that some of CEI’s customers supply the components.

CEI also can buy the raw materials and partial products for its clients and convert them into finished goods. “The ability for us to manage all those discreet supply chains for companies and maintain their inventory accuracies is something that differentiates us from our competitors,” Davis says.

The company is seeing much demand for these services, he adds. “We see big and small customers moving in that direction because they want to concentrate on marketing and distribution, and want us to take over the supply chain,” Davis says.

Significant Advantages

CEI’s location in Holmdel operates as a foreign trade zone. “When you’re bringing in components or raw materials from overseas, we’re able to bring those in duty free,” Davis says.

“The duty is paid on what we ship out, which brings significant advantages to those customers,” Davis says, noting that CEI will soon expand this capability to another location. “By mid-year of ’16, we’ll have that in place in our Roanoke, [Va.], facility.”

A significant portion of the components CEI utilizes come from overseas. “There’s varying levels of duty applied to those items, [which] offers the ability to save quite a bit of money with our customers as we flow those through our foreign-trade zones,” Martin says.

At Higher Levels

The performance skin and hair care sector is growing, and CEI is expanding with it, Davis says. “We’ve invested heavily in equipment and assets that are driving our strategic plans of growth,” he says.

These investments are helping CEI meet the needs of its customers, Davis says. “We’re seeing a lot more companies that are going to firms like us to drive speed to market or innovate products,” he says.

“We’ve also consolidated our purchasing team into a corporate group which allows us to acquire raw materials and components,” he continues. “But [we’re also] localizing our supply chain and customer service efforts to be closer to our customers.”

Martin adds that CEI has created an infrastructure in its manufacturing facilities that allows it to be an extension of its customers’ brands. “When they come to someone like us, they’re looking for someone to execute a seamless transition from their companies to ours,” Martin describes.

“There are a lot of opportunities to go off the rails and end up with a bad outcome,” Martin admits. “But the local planning, execution piece and interface with the customer really give us the ability … to deliver on a high level of consistency.”

Catering to the Complex

CEI’s work can be challenging, Davis admits. “Every customer has a different way of handling his or her own supply chain,” he says. “Everything going on in their world funnels through us. It’s an everyday challenge, for sure.”

But the company’s flexibility helps in this task, Martin asserts. “We cannot impose a way of doing things on our customers,” the CEO explains. “They come to us with a way of wanting to be managed and served.

“We have to react to that and integrate that through our approach and systems,” he says. “It’s a bit of an art [to be] able to manage these different customer services and profiles across the mix of clients that we work with.”

At the end of the day, “We like that complexity,” Martin asserts. “We don’t want to lose that uniqueness in how we cater to a specific customer.”

In a Good Spot

Martin sees a strong future for CEI. “As a company, it feels like we’ve picked a very good strategy for where this marketplace is going,” he says, noting that more brick-and-mortar companies will want to outsource their manufacturing.

“This is also an industry that will continue to consolidate,” he says, noting that CEI plans to acquire more firms and expand on its resources. “We think we’re in a good industry and a good spot.”